The BFSI sector contributes approximately 13% to India’s GDP, with NBFCs playing a crucial role in expanding credit access. As of FY24, NBFCs accounted for a significant share in key asset classes: infrastructure financing (~23%), MSME loans (~23%), auto financing (~14%), personal loans (7%), and MFIs (5%). Their rapid expansion, particularly in MSME and microfinance lending, is not only driving economic growth but also creating a surge in job opportunities.

As NBFCs scale their operations to meet the rising credit demand, they increasingly rely on contract staffing to enhance agility and efficiency. This trend has driven sharp demand for job roles such as sales executives, field officers, collection agents, tele-callers, and loan officers, ensuring faster loan disbursement and improved customer outreach. The staffing industry has witnessed over 15% YoY growth in FY24, with BFSI emerging as one of the most significant contributors to the formal flexi-staffing market. The strong interdependence between workforce expansion and flexibility is fuelling business growth and creating widespread employment opportunities, particularly for youth and semi-skilled professionals in emerging markets, further strengthening India’s economic and financial inclusion efforts.

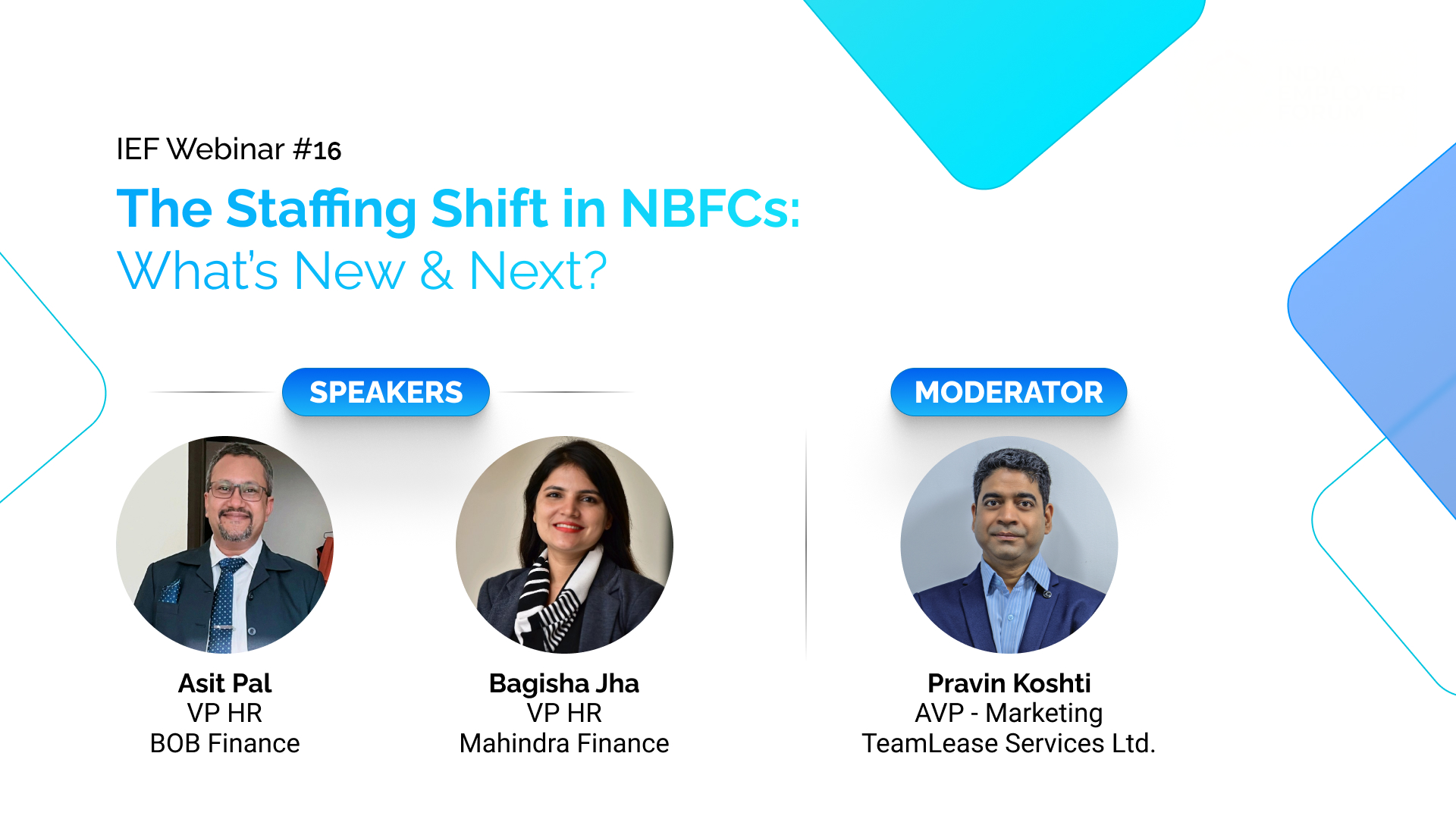

In this closed-door webinar, eminent corporate leaders had a productive discussion on the staffing shift and job trends in NBFC. The webinar had two eminent industry experts who shared their views on evolving regulations, gender diversity and infant attrition. Pravin Koshti, Marketing Head, TeamLease Services Limited, moderated the session.

When asked about automation transforming job roles in the NBFC sector, Asit Pal, VP HR, BOB Finance, said, “If we look at history, we had the IT revolution, which transformed our country from being considered a poor, third-world nation to a globally recognised name. This evolution mirrors how, before the 1990s, we were under the constraints of the License Raj. Once we opened up to the world, our economy and industries saw remarkable growth. Similarly, AI and digitisation are now poised to take us to the next level. Over time, history has shown us that improvements in technology have enhanced our lifestyles. The advancements we see externally—whether in products, services, or overall efficiency—have progressively improved. Automation will continue this trend by offering more refined and innovative solutions, whether in the form of virtual or physical products. These products will be better designed, more functional, and more resilient.

With the rise of AI and digitisation, certain new-age roles, such as data scientists, have already emerged and are in high demand. However, traditional roles will also continue to be relevant because, regardless of automation, human intelligence is indispensable. The ability to navigate complex situations using critical thinking, problem-solving, and adaptability—often referred to as jugaad—is a uniquely human trait”.

The second expert on the panel Bagisha Jha, VP HR, Mahindra Finance spoke about tackling infant attrition. She said, “While, of course, we rely heavily on virtual training and e-learning modules—since a lot of the content is recurrent—we have a very strong e-learning platform. We also have a dedicated team that continuously creates content based on evolving needs. However, physical training is still present, though it is not necessary to conduct training across all 1,400+ branches. Instead, training primarily serves as a refresher.

Additionally, we engage with a lot of new-age content formats, such as learning memes and short reels, to reinforce key messages. These are particularly effective after virtual instructor-led sessions, in-person training, or longer e-learning modules. Given that a significant portion of our workforce now consists of Gen Z employees—whose attention span is typically around 30 seconds—we have started leveraging these bite-sized learning formats. It functions much like an Instagram post, ensuring that learning remains engaging and impactful.”

View the entire session here: IEF Webinar #16 | The Staffing Shift in NBFCs: What’s New & Next?