Earlier this year, the Reserve Bank of India (RBI) issued a crucial notification directing its regulated entities to implement robust compliance management systems. This directive followed an extensive assessment of selected entities to evaluate the use of technology and automation in their internal compliance functions. The conclusion was clear: financial institutions must adopt and implement advanced technology to enhance the effectiveness of their compliance monitoring systems.

The RBI’s directive comes in response to the rising instances of penalties and license/registration cancellations imposed on defaulting institutions over the past few years. In FY24, the RBI levied monetary penalties on 283 financial institutions and cancelled the licenses/registrations of 50 banks and Non-Banking Financial Companies (NBFCs). The previous fiscal year (FY23) saw fines imposed on 223 institutions and 65 license/registration cancellations. These statistics underscore the urgent need for financial entities to bolster their compliance frameworks.

The banking industry operates within a complex regulatory framework that has grown increasingly intricate with the advent of technology-based offerings. Financial institutions are struggling to keep pace with their regulatory obligations, often resulting in significant compliance lapses. The rapid evolution of financial products and services necessitates a dynamic approach to compliance, one that can swiftly adapt to new regulations and guidelines. Internal pressures such as deadlines and business targets further exacerbate the problem. Employees under pressure to meet these targets may cut corners and overlook critical compliance requirements. This not only puts the institution at risk of regulatory penalties but also undermines the overall integrity of the financial system.

One of the fundamental issues identified in the RBI’s assessment is the lack of robust, transparent, and comprehensive internal control over compliance functions. Financial institutions often lack the visibility needed at the senior management level to take proactive steps to mitigate non-compliance risks. This lack of oversight has led to repeated violations and increased scrutiny from the central regulatory body.

To address these challenges, the RBI has emphasised the need for financial institutions to leverage technology and automation. The new directive advises all regulated entities (REs) to comprehensively review and enhance their internal compliance tracking and monitoring processes. The REs are required to institute necessary changes to their existing systems or implement new ones by June 30, 2024.

The central bank has outlined specific requirements for these compliance monitoring solutions to ensure they are effective and comprehensive. These requirements include:

- Platform for Effective Communication and Collaboration: The solution must facilitate seamless communication and collaboration among all stakeholders, including business, compliance, IT teams, and senior management.

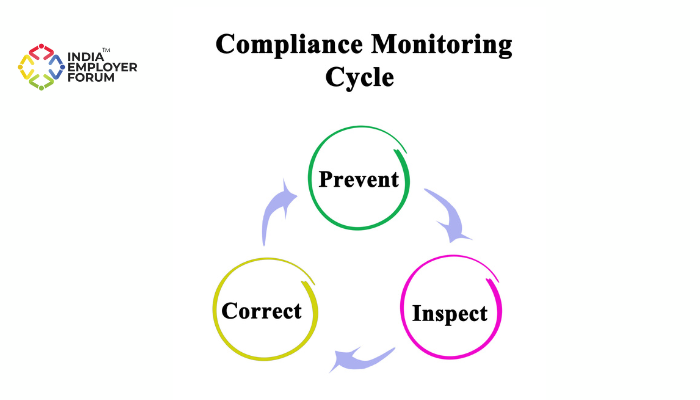

- Identification, Assessment, Monitoring, and Management: The solution should be capable of identifying, assessing, monitoring, and managing compliance requirements.

- Escalation of Non-Compliance Issues: The system must be able to escalate any issues of non-compliance promptly.

- Recorded Approval for Deviations: Any deviations or delays in compliance submissions or filings must receive recorded approval from a competent authority. This adds a layer of accountability and ensures that all deviations are justified and documented.

- Unified Dashboard for Senior Management: The solution should provide a unified dashboard view to senior management, giving them a comprehensive overview of the compliance position of the RE as a whole. This transparency allows for better decision-making and oversight.

This directive is a significant step towards India’s digital transformation. Over the years, businesses have digitised numerous processes and functions, such as payroll management, security, access control, workflow, and inventory management. By requiring REs to strengthen their internal compliance monitoring systems, the RBI aims to significantly boost compliance functions’ efficiency, efficacy, transparency, and accountability. Implementing such a system will allow REs to pinpoint deficiencies in their existing processes and take necessary steps to mitigate them. The move towards digital compliance solutions will enhance regulatory adherence and support sustainable growth and operational integrity within the financial sector.

The current technology-based digital solutions in the market come equipped with these required functionalities and can help REs transform their compliance functions. These RegTech solutions also offer additional utilities that can help the top management focus on critical/high-risk compliances which may severely impact the company’s reputation and/or stability. With automatic advance reminders for compliance obligations, non-compliance or compliance delays are avoided. Intuitive dashboards and graphical reports help in entity-wise / location-wise / user-wise comparison of compliance performance and help in quick decision-making. By adapting digital solutions, financial institutions can avoid penalties brought on by lapses, delays and defaults resulting from ad-hoc, paper-based, and people-dependent compliance processes. These solutions allow REs to stay on top of all RBI’s circulars, directions, notices, and advisories.

Technology is transforming the financial institutions and the banking industry. They now have the capability to detect contraventions and take appropriate steps to mitigate and curtail such behaviour. They must take advantage of such capabilities as they are the pillars of the financial system in any economy.