Higher pension is a good opportunity for members under the Employees’ Pension Scheme, 1995. “Retirement planning is the most neglected financial goal in India. The option to get an enhanced pension would help EPS members to get an assured income at the time of retirement,” however, one must ascertain the quantum of benefit from opting higher pension.

A brief history of higher pension

Employees’ Pension Scheme was introduced on 16th November 1995 and it is a Social Security Scheme administered by the Employees’ Provident Fund Organization to provide the pension to members/employees after retiring at the age of 58 years / in case of death (uncertainty) who works in the factories/establishments/organization.

Under Para 26(6) Employees’ Provident Fund Scheme, allows members to contribute more than the prescribed PF wage ceiling i.e., ₹5000/- (From 16th November 1995 to 31st May 2001), subsequent enhancements of wage ceiling to ₹6500/- (From 1st June 2001 to 31st August 2014) and currently, ₹15,000/- (from 1st September 2014 onwards), provided that the employer gives an undertaking in writing that shall pay administrative charges which are payable and joint consent from employee and employer shall be submitted to PF department.

Despite certain classes of employees or establishments contributing PF higher than the wage ceiling wherein, pension contribution was restricted to the wage ceiling and remaining contribution was diverted to EPF corpus, the said process was raised as a dispute by said employees to consider pension contribution as per their actual Basic wages (PF wages) instead restricting to the wage ceiling.

Though EPFO extended 6 months timeline to exercise higher pension those who were part of higher pension prior to 1st September 2014 and continue to contribute on higher pension, provided 1.16% additionally to be contributed by said members on higher wages. Further, EPFO has not extended / visibility to such provision to the employees/employers who were contributing higher than the wage ceiling and EPS has been restricted to capping.

Hon’ble Supreme Court pronounced the verdict in the matter of Employees’ Provident Fund Organization (EPFO) and Another vs. Sunil Kumar and Others, Special Leave Petition (C) Nos. 8658-8659 of 2019) dated 04th, November 2022 and highlights are cited herein below:

- The Supreme Court directed EPFO to complete the paperwork within 8 weeks from the date of judgment.

- Exercising the joint consent by the employee and employer has been extended to 4 months from the date of judgment (Currently it has been extended to 26th June 2023).

- An additional contribution of 1.16% by an employee has been kept in abeyance for the period of 6 months from the date of judgment.

- The higher pension option was extended to exempted establishments, too.

How to ascertain whether a higher pension is beneficial

- Every employee must ascertain his / her contribution towards a pension (EPS) which is 8.33% of earned Basic wages (PF wages) on Rs.15000/- and additional higher wages, EPS percentage shall be at 9.49%.

- Interest is not applicable to EPS contribution, wherein the entire EPF corpus which is 12% of the employee’s share and the difference of the employer’s contribution shall earn interest year on year as per the percentage declared by EPFO.

- Member/employee is not allowed to withdraw EPS contribution on completion of the eligible period i.e., 10 years (9.6 years) however, EPF corpus shall be withdrawn after retirement/separation.

- In case of any uncertainty to pensionable employees after retirement, the nominee shall be eligible to receive 50% of the pension received by the deceased member and 75% to the Orphans.

- Opting for a higher pension is optional and it is not mandatory.

- Once a higher pension is opted/exercised, it cannot be revoked.

- If a member withdrawn (partial withdrawal/advance/ Covid advance) the said amount shall be payable to EPFO if there is a deficit in the EPF corpus while diversion from EPF to EPS.

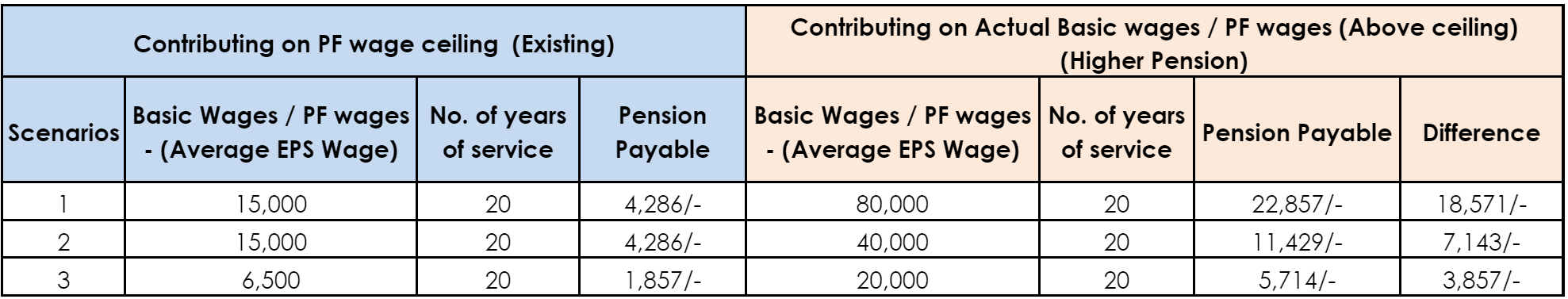

- EPS formula – Last 60 months average EPS wages X number of years of EPS membership / 70.

- Interest earned by an employee/member shall be deprived or nullified as on date while diversion from EPF corpus to EPS account.

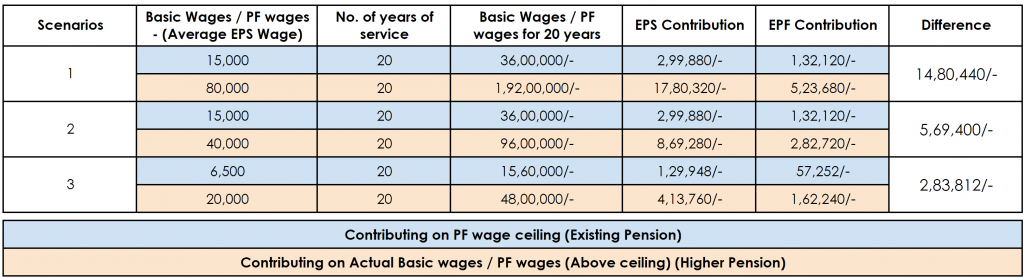

Sample calculation – Existing pension contribution v/s higher pension

The below-furnished table provides the existing pension v/s higher pension and contribution to be diverted from the existing EPF corpus to EPS (which can be ascertained from the column of difference in Table two).

(Disclaimer: The calculation as per the formula cited by EPFO and there shall be slight variation as other factors to be considered i.e., [NCP (Non Contributory Payable Days, Actual EPS earnings & etc.])

Conclusion:

In light of the above-cited facts and scenarios, an individual has to ascertain which option shall be more beneficial based on the contribution made by him/her to EPFO as of now, accordingly, it is suggested to opt or exclude from exercising the higher pension option.

Contributed by: TeamLease HRtech

You might also be interested to read: Remarkable Women in Science and Technology