Come April and Indian taxpayers will have to choose between whether to stay with the old tax regime or the new tax regime. Indian Finance Minister Nirmala Sitharaman introduced three new income tax slabs in India as she presented the Union Budget 2020. This is the second budget presented by the Modi-led Government after it returned to power last year. This year, the budget was centered on the ideas of Aspirational India, A Caring Society, and Economic Development. One of the highlights of the budget 2020 is the introduction of three new tax slabs for taxpayers in India.

Though Sitharaman has termed the introduction of these new income tax slabs in India as a new and simplified personal tax regime, experts feel otherwise. They feel that the tax structure has become complicated with the introduction of these three tax slabs. Besides the introduction of these new tax slabs, there are as many as 70 exemptions and deductions that Indian tax payers won’t get in the new regime. Compliance will simplify with the removal of tax deductions and exemptions but it will certainly come as a blow to tax planners. Those who have managed to save on their tax deductions so far will have to shell out more in the new tax regime.

You might also be interested to read: Policies For Maximizing Governance

Here are some of the key proposals from the budget which will impact the Indian taxpayers:

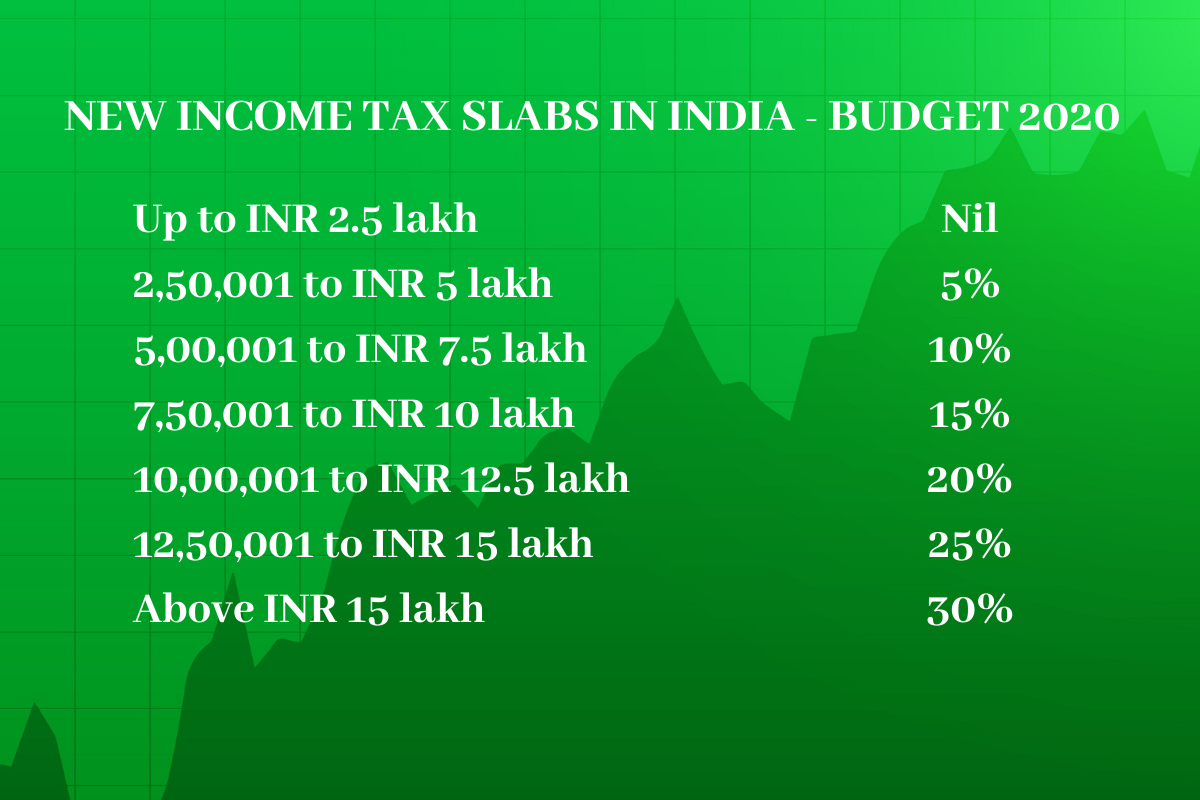

1. The income tax slabs in India according to the new tax regime

| Up to INR 2.5 lakh | Nil |

| 2,50,001 to INR 5 lakh | 5% |

| 5,00,001 to INR 7.5 lakh | 10% |

| 7,50,001 to INR 10 lakh | 15% |

| 10,00,001 to INR 12.5 lakh | 20% |

| 12,50,001 to INR 15 lakh | 25% |

| Above INR 15 lakh | 30% |

2. Deletion of exemptions

The budget introduced a proposal where the new tax slabs have been introduced under section 115BAC. Taxpayers will have to do away with a number of concessions, deductions and exemptions that were available under Chapter VI-A. This will include the investments under Section 80C, medical insurance premium, HRA and leave travel allowance.

For instance, if an average taxpayer in India claims deductions for INR 2.5 lakh, which includes 1.5 towards 80C, 0.5 towards NPS and further 0.5 towards standard deduction, the tax will remain unchanged. Further, if taxpayers also claim HRA (house rent allowance) exemption or home loan interest deduction on INR 2 lakh, the tax amount will be lower by INR 46,800 in the old regime.

3. Option to choose the new tax structure

The taxpayers, depending on their financial condition, will have the option to choose the new tax structure. However, taxpayers who make good use of the exemptions and deductions like HRA, 80C and medical insurance will, in no way, benefit from the new tax regime. The surcharge on income tax though has been left untouched. People with an income range of INR 50 lakh to INR 1 crore will still have to pay the tax surcharge of 10 percent. The tax surcharge increases further with the rising income levels. The tax surcharge is 15 percent for the income range of INR 1-2 crore, 25 percent for INR 2-5 crore and 37% for above INR 5 crore. Taxpayers will not benefit if they do not claim any deductions and exemptions and opt for the new income tax slabs in India.

4. Taxation of excess contribution to EPF, NPS and superannuation fund

For employees who have a good portion of salary linked to their EPF, NPS and superannuation account, there’s some bad news. As per Budget 2020 proposal, if the employer’s contribution to EPF, NPS and superannuation fund on aggregate basis exceeds Rs 7.5 lakh in a financial year, then the employees will be taxed for the excess amount.

The new income tax slabs in India are useful for people who have made fewer investments in policy schemes as there are seven lower tax slabs. Taxpayers who do not claim exemptions in the existing regime are likely to benefit as they can pay lesser upfront rates of tax. Considering taxpayers with an annual taxable income of INR 12 lakh and investments of less than INR 1.91 lakh, they will have to shell out more tax if they follow the old tax regime. The new regime will be beneficial for people who opt for lesser investments in tax-saving schemes.

You might also be interested to read: Corporate Governance In VUCA World

However, on the flip side, the new tax regime will lead to lower tax rates as exemptions and deductions are removed. Taxpayers who heavily invest in tax-saving schemes like NPS, PPF and claim deductions and exemptions will not benefit if they opt for the new tax regime. By opting for the new tax regime, even with a lower tax rate, they will shell out more as they cannot claim any exemptions or deductions. Taxpayers can get major respite in the existing tax regime if they claim up to INR 2 lakh in tax deductions. The new income tax slabs in India will also most likely lead to lesser domestic savings as people will not invest in tax-free schemes due to the curtailment of deductions and exemptions. Taxpayers will have to determine the tax liability in the existing income tax slabs rates and choose what works best for them.

Reference: Six income tax slabs in, 70 exemptions out: Impact on taxpayers, economictimes.com, 05 Feb 2020