Finance Minister Nirmala Sitharaman, in a press conference dated, 13th May, 2020, itemized the Rs 20 lakh crore COVID relief package, announced by Prime Minister Narendra Modi. This stimulus package is equivalent to 10% of India’s GDP, one among the largest stimulus packages so far compared to the rest of the world.

The Rs 20 lakh crore package included the first COVID relief stimulus amounting to Rs 1.70-lakh crore, which was announced on March 26, including the Rs 3.74-lakh-crore liquidity infusion into the financial system by the Reserve Bank of India. The government has labeled this as the Pradhan Mantri Garib Kalyan Yojana for the poor to fight the battle against coronavirus. The package has been themed around the five pillars of Atmanirbhar Bharat – Economy, Infrastructure, System, Vibrant Demography and Demand. The bedrock of these government measures is predominantly focused on putting India back to work and reviving the economy.

Related Reads

- Indian Economic Growth Revival Post COVID-19

- Social Security Reforms in India – Upcoming Labour law change

For MSMEs

MSMEs have received the deepest cut in this coronavirus crisis. To reignite their businesses and ease their operational liabilities, the government has announced Rs 3 lakh crores loans for MSMEs with no guarantee fee and no fresh collateral. The loans will have a four year tenor with a moratorium of 12 months on principal repayment. This scheme can be availed through 31st Oct, 2020. It is estimated that 45 lakh units can resume business activity and safeguard jobs with this scheme.

The stressed MSMEs, as quoted by the finance minister, need equity support, hence the government facilitates provision of Rs 20,000 cr as subordinate debt. Two lakh stressed MSMEs are likely to benefit from this scheme.

As MSMEs lack equity, Rs 50,000 cr equity infusion through Fund of Funds has also been further announced. Fund of Funds with Corpus of Rs 10,000 crores will be set up and operated through a mother fund and daughter funds model. This is aimed to provide equity funding for MSMEs with growth potential and viability and empowering them to get listed on main board of stock exchanges.

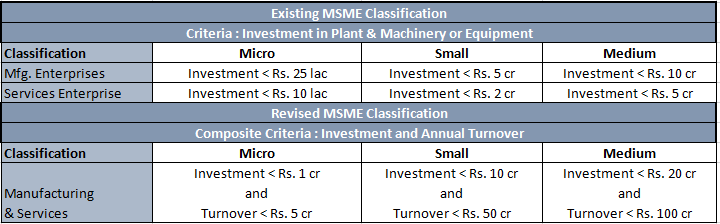

The crux of the announcement was centered around the redefinition of MSMEs. The exhibit below elucidates the revised definition of MSME as announced by FM Sitharaman in the press conference.

EPF support

In the first tranche of the Pradhan Mantri Garib Kalyan Yojana package, 12% of employer and 12% employee contributions was announced to be credited into the EPF accounts of eligible establishments; for wage-earners below Rs 15,000 p.m. in businesses having less than 100 workers for the month of March, April and May. This support has been extended further to June, July and August 2020, providing liquidity relief of Rs 2500 cr to 3.67 lakh establishments and for 72.22 lakh employees.

For the workers and businesses who are not eligible for the 12% of employer and 12% employee EPF support, the government has conferred a statutory PF contribution of both employer and employee to be reduced to 10% each from existing 12% each for all establishments covered by EPFO for the next three months. This scheme will authorize an increase in take home salaries for employees and provide some relief for employers in payment of provident fund dues.

TDS/TCS rate reduction

Payment of contract professional fees, interest, rent, dividend, commission, etc. will be eligible for a reduced TDS rate of 25% of the existing rates. This reduction is applicable with immediate effect until 31st March, 2021. This measure will allow cash flows at the hands of the taxpayers, releasing liquidity of Rs, 50,000 crore.

All income-tax return filings for FY 2019-20 has been extended from 31st July, 2020 & 31st October, 2020 to 30th November, 2020. Similarly, tax audit has been extended from 30th September, 2020 to 31st October, 2020.

Statutory and compliance relaxation measures

- Last date for Income Tax Returns has been extended to June 30, 2020

- GST filing returns has been extended to June end 2020

- 24*7 custom clearance till 30th June, 2020

With Prime Minister Narendra Modi confirming lockdown 4.0 on Tuesday, new norms, new regulations, and new rules will form but with a way-forward viewpoint and with the beginning of many economic activities.